What is DeXian Staking Earning?

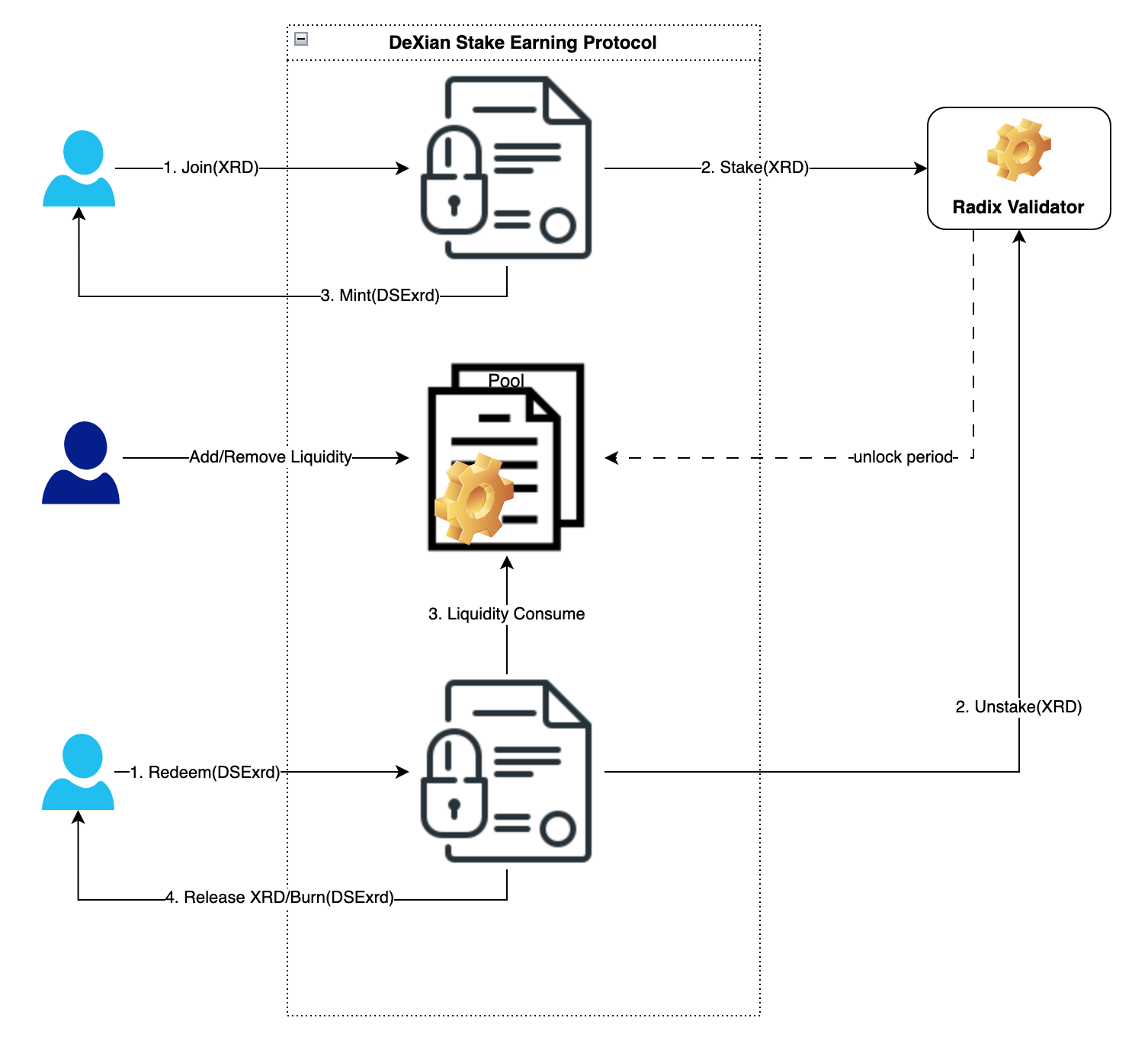

DeXian Staking Earning (DSE) is a liquid staking protocol based on Radix, allowing users to fast JOIN the liquid staking, and earn stable proceeds through the DeXian service. Especially, users can immediately REDEEM their XRD invested without waiting for the Radix unstaking delay.

The DSE protocol will use algorithms to ensure that XRD staked by users will not be concentrated on a few validators, increasing the decentralization, stability and robustness of the Radix network.

Who are we?

DeXian Stake Earning was developed by the technical team of KaiYuan Epoch Validator, which is currently a Radix Top 40 validator worldwide. The DeXian team has been following the Radix since 2018, participating in early Betanet network testing in 2021, and operating validators on Olympia and Alexandria.

We also contributed to a series of Radix Scrypto-Challenges and translated white papers including Radix DeFi and Cerberus consensus (A Parallelized BFT Consensus Protocol for Radix) into Chinese, which played an important role in the promotion of Radix in the Chinese community.

What exactly does DSE protocol solve?

DeXian provides a one-stop solution to the problem of Fast stake and even Faster unstake, providing users with convenience and increasing the liquidity of XRD. It allows users to eliminate waiting for the approximately 10 to 15 days unstaking delay of Radix, thus improving capital utilization.

How does DSE work before Babylon smart contracts go live?

The DeXian Staking Earning currently operates in a centralized way and it is an MVP (Minimum Viable Product) before the decentralized service DSE Beta goes live.

The following are illustrative examples.

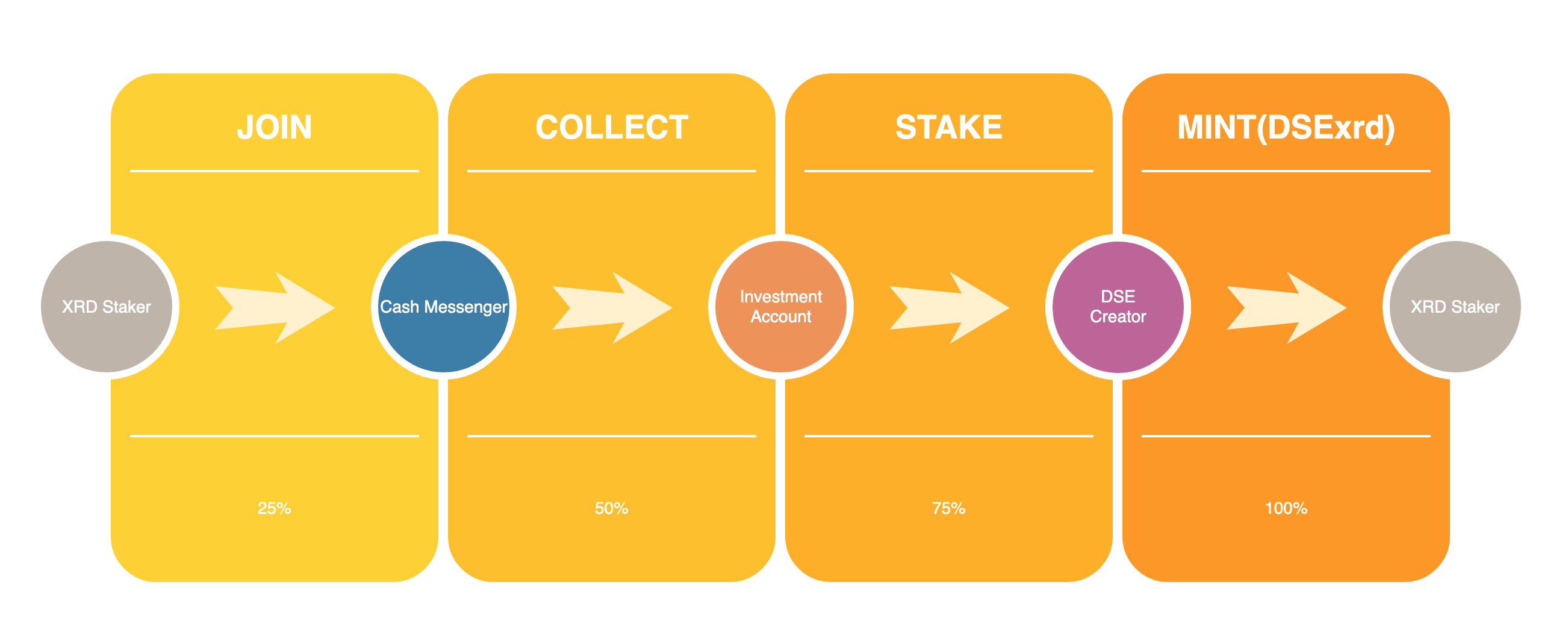

JOIN

-

Users JOIN 180 XRD, the net value of DSE units at this point is 1.09XRD/DSExrd (2023.2.20) https://stokenet-explorer.radixdlt.com/#/transactions/4731637ffb30819ae967e775283085a649861b7a42560af4381632e2605190ae

-

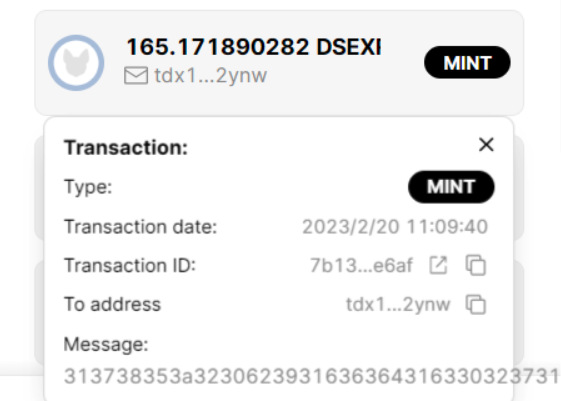

Users will receive approximately 165 DSExrd equivalent to 180XRD. DSExrd will only mint when JOIN occurs.

https://stokenet-explorer.radixdlt.com/#/transactions/7b13576b36fd158882d95e68fdfed6ee351cf5b676c8d9d2d1572c5245bee6af

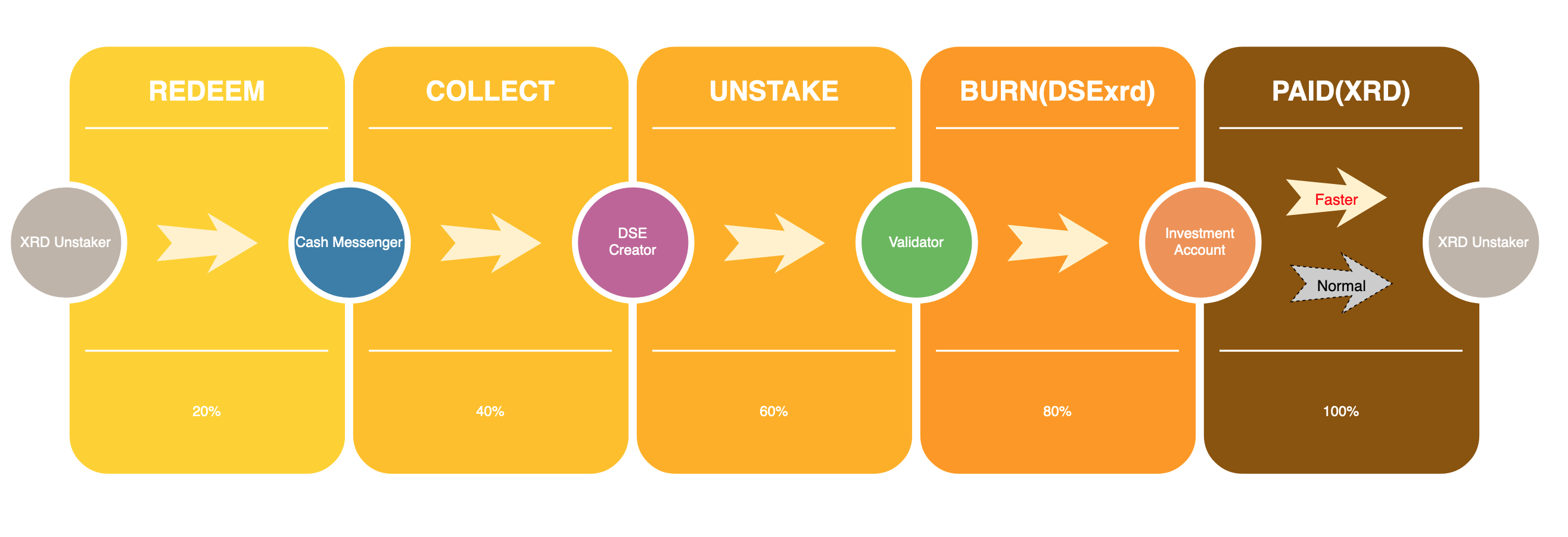

REDEEM

-

Users want to REDEEM 50 DSExrd after certain time, the net value at this point is 1.02 (2023.1.12).

https://stokenet-explorer.radixdlt.com/#/transactions/2d047be598e63fa263fd14427a1efae568cd0d1c9ef8110c06c14b2f4aaa307e -

Users will receive approximately 51 XRD equivalent to 50 DSExrd, while the redeemed DSExrd will be burned. (A fee will be charged for fast redemptions)

https://stokenet-explorer.radixdlt.com/#/transactions/d0e1a77a52de21ce80a61d265f785315ad31c9f06f5ab532d5e3c6d9dc7aba6b

Burn records:

https://stokenet-explorer.radixdlt.com/#/transactions/f0fa8ea84e9c18f719cdc23c5303fe2bdadd42333171c8b92c5a2d6fcb2a3814

How does the DSE generate earnings?

DSE is supported by the earnings generated from staking return on Radix validators, and ALL of these earnings are shared by DSExrd holders. The net value of DSExrd will increase steadily as the user’s holding period gets longer, while the yield of DSExrd will fluctuate along with the Radix staking APY.

Where do all the XRD go that users join? How does DSE select the validator?

The XRD that users join through DSE are staked on Radix validators. DSE will select the validators based on algorithms which consider multiple factors (ranking, fees, recent uptime, etc.), and as DSE is currently an MVP and focuses on functional integrity, it simply selects KaiYuan Epoch.

Where do the funds in the current DSE funding pool come from? Does it support unlimited fast redemptions?

In the current MVP phase, the funds of the pool are actively raised by DeXian community advocates. When users select the fast redemption option, the buffer pool will release a sum of funds for immediate payment, which is also the reason why a fee is charged for this service.

However, when the requested amount for fast redemption exceeds the pool balance, the user will not be able to use the fast redemption service and DSE will only support the normal redemption service at this point, which we have also explained in detail at the redemption interface.

What is the roadmap for DSE once Babylon and the native liquid stake go live?

Once Babylon and the native liquid stake go live, DSE will also be re-implemented using Scrypto, allowing any user to provide liquidity to the pool through the DSE protocol, while the interest rate for fast redemption will be market-oriented and dynamically adjusted based on supply and demand, with the liquidity provider sharing in the interest rate gains.

DeXian will also further extend and integrate the funding pool with Lending Protocol to diversify the DeFi ecosystem and practical application scenarios of XRD.

What about the fee for fast redemption?

Currently, the fee charged for fast redemption is basically equal to the 10 to 15-day staking earnings.

Is DSExrd available for trading?

DSExrd can transfer and trade. It can also be traded on DEX such as Ociswap by creating liquid pools.